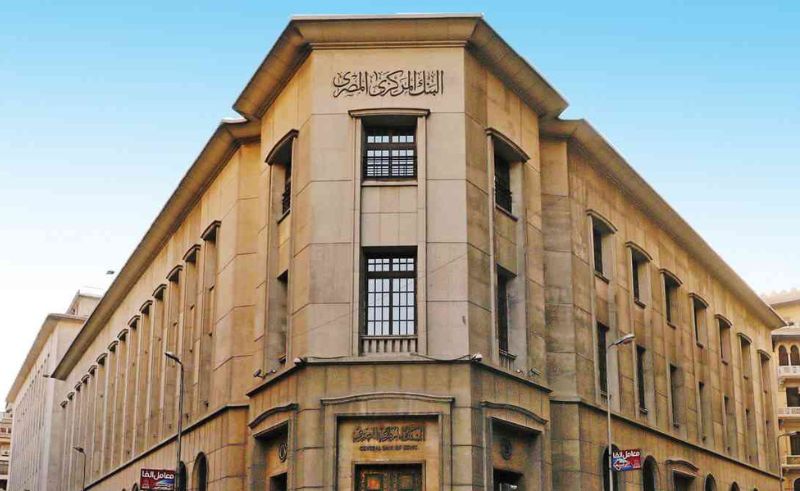

Egypt’s Banking Sector Sees USD 10.3 Billion Rise in Foreign Assets

The CBE report highlights liquidity strategies and a September surplus, underscoring the strengthening of Egyptian banks.

The Central Bank of Egypt (CBE) announced that the Egyptian banking sector achieved a net foreign assets surplus of USD 10.3 billion (EGP 498.6 billion) in September, marking an increase from USD 9.7 billion (EGP 473.3 billion) at the end of August. This continued improvement reflects ongoing stability in Egypt's foreign asset levels, after first achieving a positive balance in May 2024.

According to CBE data, the sector’s total foreign assets reached EGP 3.562 trillion in September, an increase from EGP 3.531 trillion in August. Meanwhile, the total foreign liabilities amounted to EGP 3.064 trillion in September, compared to EGP 3.058 trillion in August.

The growth in Egypt's local liquidity was also noted, as it rose to EGP 11.081 trillion in September 2024, a significant jump from EGP 8.877 trillion in December 2023. The money supply reached EGP 2.760 trillion in September, up from EGP 2.370 trillion last year. The cash flows outside the banking system recorded EGP 1.168 trillion, indicating an increase from EGP 1.068 trillion in December 2023.

The report also highlighted increases in non-governmental deposits within Egypt's banks. Deposits in local currency surged to EGP 7.207 trillion by September 2024, up from EGP 6.247 trillion at the end of 2023. Demand deposits in local currency amounted to EGP 1.592 trillion, with significant contributions from the public business sector (EGP 106.8 billion), the private sector (EGP 908.4 billion), and the household sector (EGP 577.6 billion).

Time deposits and savings certificates in local currency saw notable growth, reaching EGP 5.615 trillion by September, compared to EGP 4.946 trillion in December 2023. The household sector contributed the most with EGP 5.199 trillion, while the public business and private sectors accounted for EGP 68.3 billion and EGP 348.1 billion, respectively.

Non-governmental deposits in foreign currency also rose significantly, totaling EGP 2.705 trillion in September, up from EGP 1.561 trillion in December 2023. Demand deposits in foreign currency were recorded at EGP 672.9 billion, with the household sector holding EGP 188.2 billion and the private business sector EGP 453.1 billion. Time deposits and savings certificates in foreign currencies stood at EGP 2.032 trillion, with substantial holdings from the household sector (EGP 1.437 trillion), private sector (EGP 454.5 billion), and public business sector (EGP 141.2 billion).

This report signals strengthened resilience within the Egyptian banking system, reflecting CBE’s efforts to manage liquidity and bolster foreign asset positions amid changing global financial conditions. The rising local and foreign deposits highlight confidence in the system and its potential to drive economic stability.

- Previous Article Italian-Palestinian Duo No Input Debuts Eponymous Electro EP

- Next Article PIF Signs USD 51 Billion Deals With Japanese Financial Firms