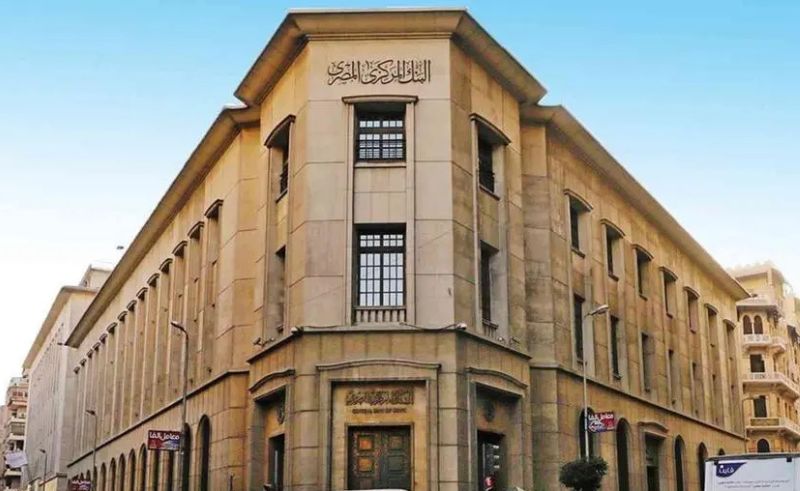

Egyptian Banks Post First Net Foreign Asset Surplus Since July 2024

The surplus reflects growing foreign inflows, with sector-wide net foreign assets rising 47.5% to USD 15.04 billion, driven by investments and improved foreign currency positions.

Egypt’s commercial banks reported a net foreign asset surplus of USD 2.5 billion in March 2025, recording the first surplus since July 2024. The shift comes after a USD 1.9 billion deficit in February.

The overall net foreign assets (NFA) for the banking sector, including the Central Bank of Egypt (CBE), rose sharply to USD 15.04 billion in March, up from USD 10.2 billion a month earlier — a 47.5% increase according to official figures.

The Central Bank’s position also improved, with net foreign assets increasing by USD 411 million during March to reach USD 12.5 billion.

The recovery in foreign assets was further supported by renewed investor appetite for Egyptian debt instruments. In March alone, USD 4 billion flowed into Egyptian government securities via the secondary market, signalling increased confidence in the country’s economic outlook.

The return to surplus territory highlights the impact of ongoing economic reforms and stabilisation efforts, as Egypt works to strengthen its foreign currency reserves and ease pressure on the banking system’s foreign commitments.

- Previous Article Michael Bublé to Perform in Egypt’s New Capital

- Next Article Inside Egypt’s Seven UNESCO World Heritage Sites