Egypt-Based Khazna Secures $16 Million to Expand Into Saudi Arabia

With over 500,000 users and fresh funding, Khazna sets its sights on Saudi Arabia, and a digital banking license in Egypt.

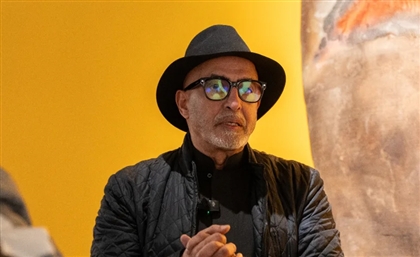

Khazna, an Egypt-based fintech company led by co-founder and CEO Omar Saleh, is expanding into Saudi Arabia with $16 million in fresh pre-Series B funding led by global investors and regional investment firms, including Quona and Speedinvest, Aljazira Capital, anb Seed Fund, DisrupTECH, ICU Ventures, Khwarizmi Ventures and SANAD Fund.

Unlike BNPL players, Khazna is focusing on payroll-backed lending, pension-based credit, and earned wage access (EWA). With nearly three million Egyptians living in Saudi, the company sees potential in cross-border financial services, tapping into the region’s massive remittance flow.

At home in Egypt, Khazna is also pushing for a digital banking license. Founded in 2019, it serves low- and middle-income workers with salary advances, microloans, and digital payments. In 2022, it had just raised a $38 million Series A with more than 150,000 customers across its products. Today, Khazna has grown its user base to over 500,000 people.

“The biggest game changer here is for us to get access to user deposits,” Omar Saleh, CEO and co-founder of Khazna, said. “There’s a huge opportunity for us to capture part of that market as well in a way that will make our cost of funding much more attractive than it is today.”

An eventual IPO on Saudi’s Tadawul stock exchange is also in play, with plans to have nearly half of its business in Saudi within four years.

- Previous Article Egypt Proposes USD 53 Billion Plan to Rebuild Gaza

- Next Article Inside Egypt’s Seven UNESCO World Heritage Sites