Saudi-Based Fintech Lean Raises $67.5 Million Series B for Expansion

The Riyadh-based fintech startup raised $67.5 million in Series B funding led by General Catalyst, boosting its open banking platform to expand financial services across the UAE and Saudi Arabia.

Lean Technologies, a Riyadh-based fintech infrastructure provider, secured $67.5 million in Series B funding, bringing its total funding to over $100 million. This round was led by General Catalyst, marking the firm’s first investment in a Saudi startup. The funding round also saw participation from Bain Capital Ventures, Duquesne Family Office and Arbor Ventures.

Founded in 2019 by Hisham Al-Falih, Aditya Sarkar and Ashu Gupta, Lean offers data and payment tools through its financial APIs to help businesses in the UAE and Saudi Arabia build innovative financial products for their customers. Operating under the regulatory frameworks of the UAE and Saudi Arabia, the company has already processed over $2 billion in payment volumes through its account-to-account (A2A) payment solutions.

The company has worked with a range of high-profile clients to provide digital payment solutions. In Saudi Arabia, Lean operates under the Central Bank’s regulatory sandbox, where it has verified nearly 1 million bank accounts. Among its clients in the Kingdom are major players such as Tawuniya, Abdul Latif Jameel Finance, Salla, Tabby and Tamara.

“This funding marks a pivotal moment not only for Lean but for the entire fintech landscape in the Middle East,” said Hisham Al-Falih, CEO and Co-Founder of Lean Technologies. “Fintech is evolving from a specialized vertical into an essential layer of the region’s economic fabric, and Lean is playing a crucial role in building the infrastructure that enables seamless adoption across industries.”

Lean’s services, including its Pay-by-Bank offerings, are helping businesses streamline their payment processes and reduce dependency on traditional banking methods. With the new investment, the company aims to expand its product suite, strengthen partnerships, and scale its operations across the MENA region.

Lean Technologies intends to use the funds to scale its existing solutions, expand its open banking and Pay-by-Bank offerings, and explore new product innovations. With increasing demand for alternative payment solutions and a rapidly evolving fintech landscape, Lean is set to play a central role in transforming how businesses operate within the region’s financial ecosystem.

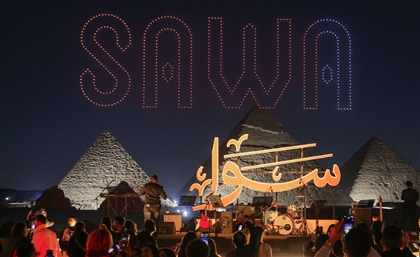

- Previous Article Italian-Palestinian Duo No Input Debuts Eponymous Electro EP

- Next Article Gawdat Drops Groovy Tech-House EP ‘You Know I Need You’

Trending This Week

-

Feb 23, 2026