Swypex Launches Egypt’s First Approval-Based Corporate Card

Backed by Accel and licensed by Egypt’s central bank, Swypex’s new product brings dynamic, policy-driven spend controls to local businesses as part of its Premium offering.

Cairo-based fintech platform Swypex has launched Egypt’s first Approval-Based Limits Card, a new product designed to give businesses precise control over employee spending. The card is available exclusively through Swypex Premium, the company’s recently introduced subscription tier for enterprise financial management.

The Approval-Based Limits Card allows finance teams to assign dynamic spending limits that remain locked until individual transactions are reviewed and approved. This model, inspired by petty cash systems, enables a rotating balance approach — giving finance departments real-time visibility and automated enforcement of internal policies.

Swypex’s rollout comes amid Egypt’s accelerating digital transformation. While mobile wallets and financial inclusion are on the rise — with over 74% of adults now financially included — nearly 94% of business payments remain undigitised. Swypex aims to close that gap by delivering fintech solutions tailored to Egypt’s business environment, while adhering to global product standards.

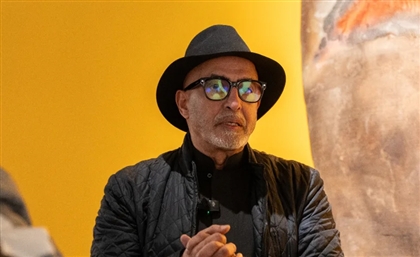

“Egyptian businesses want control without friction, and this card gives them exactly that,” said Ahmad Mokhtar, Co-Founder and CEO of Swypex. “Approval-Based Limit Cards bring a new standard of precision and agility to business finance. It’s the bridge between old-world cash management and seamless, secure corporate spending.” The new card is one of several features available through Swypex Premium, which also includes unlimited cashback, flexible spend controls, and custom approval workflows. The broader Swypex platform integrates payments, invoicing, corporate cards, and financial operations into a single interface.

Swypex is licensed by the Central Bank of Egypt and backed by a $4 million seed round led by Accel — the venture capital firm’s first fintech investment in the MENA region. The company positions its platform as an end-to-end financial stack for businesses looking to modernise their operations, with onboarding that takes just three minutes.

- Previous Article Shkoon Realeases ‘Greater Than One' Remix EP

- Next Article Inside Egypt’s Seven UNESCO World Heritage Sites