UAE-Based Fintech Kema Raises $2 Million in Seed Round

The funding will fuel the company's mission to revolutionise the way businesses manage their financial operations.

Kema, a UAE-based fintech platform, has secured a $2 million pre-seed investment round led by Speedinvest and joined by the Dubai Foundation District Fund (DFDF).

Founded in 2023, Kema specialises in providing a SaaS platform tailored to assisting B2B SMEs in optimising and automating their cash flow processes. This innovative solution aims to enhance efficiency, saving valuable time and resources for businesses engaging in B2B transactions.

With the newly acquired investment, Kema intends to bolster its SaaS platform specifically designed to cater to the needs of SMEs, targeting expansion across the UAE market and recruiting top-tier talent to bolster its workforce. The funding will fuel the company's mission to revolutionise the way businesses manage their financial operations, facilitating smoother transactions and fostering growth opportunities within the SME segment.

The financial landscape in the UAE underscores the necessity for Kema's offerings, as highlighted by a 2021 report from the UAE Central Bank which revealed a business payments volume exceeding $1.5 trillion, significantly surpassing retail payments.

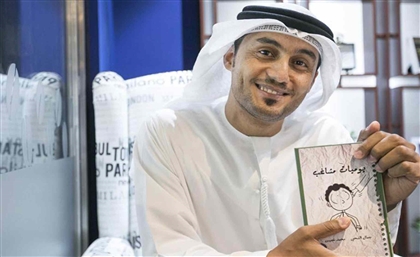

“Having worked with B2B SMEs, a healthy and predictable cash flow cycle remains elusive for many. The problem is compounded by the combination of persistent payment delays, manual invoice workflows and follow-ups, multiple disconnected systems, and limited access to SME financing,” Kema founder and CEO Michael Ghandour tells StartupScene. “As a result, many businesses get stuck in a cycle of limited growth, increasing costs, and unproductive use of their most valuable resource, their employees' time.”

As much as $44 billion of working capital can be trapped across just 424 regional companies, according to a 2023 PWC report. “We actually estimate that more than 500,000 B2B SMEs exist across MENA, suggesting that there is a staggering $400 billion in trapped working capital across their balance sheets,” co-founder and CTO Akash Rao adds.

Kema's platform offers seamless integration with leading accounting software such as Xero and Quickbooks. This user-friendly approach, coupled with the increasing recognition of digitalization's role in driving growth, particularly emphasised amidst the COVID-19 pandemic, allows Kema to facilitate SMEs' adaptation to the evolving financial landscape in the MENA region, supported by governmental initiatives aimed at empowering and fostering the growth of small businesses.

- Previous Article Italian-Palestinian Duo No Input Debuts Eponymous Electro EP

- Next Article Travel Across History on Egypt's Most Iconic Bridges

Trending This Week

-

Dec 27, 2025