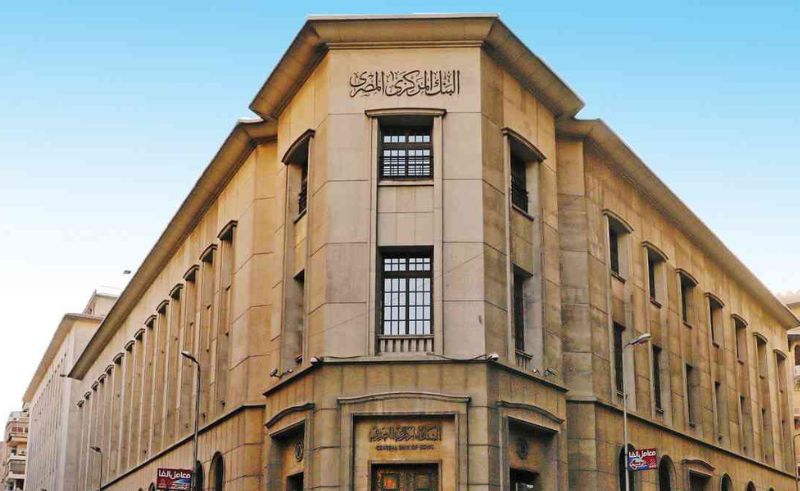

Central Bank of Egypt Issues EUR 642.8 Million in Euro T-Bills

Accepted bids amounted to the targeted EUR 642.8 million, with yields ranging from 3.5% to 4.2%.

The Central Bank of Egypt (CBE) issued EUR 642.8 million in Euro-denominated treasury bills (T-bills), aiming to strengthen the country’s debt management strategy. The T-bills, which will mature in 364 days, attracted considerable interest, with 28 bids totaling approximately EUR 922.8 million. Accepted bids amounted to the targeted EUR 642.8 million, with yields ranging from 3.5% to 4.2% and a weighted average yield of 3.69%.

This issuance is Egypt's second Euro-denominated T-bill sale in 2024, following a similar issuance of EUR 609.8 million in August. The CBE has previously issued Euro-denominated T-bills, including EUR 645 million in November 2023 and EUR 600 million in August 2023. The bank also issued USD-denominated T-bills, with totals of USD 990 million in November 2023, USD 1.61 billion in December 2023, and USD 830 million in January 2024.

The Egyptian government is working to diversify its financing tools, reduce debt and close the budget deficit as part of its commitment to the International Monetary Fund (IMF). This commitment is tied to an USD 8 billion IMF loan program, which aims to support the country’s economic reform efforts.

Recent fiscal adjustments have led to a notable decrease in Egypt’s total debt, which fell by approximately 7% in FY 2023/2024, reaching 89% of GDP, down from 95.7% in the previous year. Additionally, external debt for budget sectors has been reduced by around USD 4 billion over the past year, according to the Minister of Finance.

Egypt’s broader goal, as outlined in its IMF-backed reform plan, is to further reduce the gross debt-to-GDP ratio to around 83% by FY 2026/2027. The IMF is scheduled to conduct its fourth review of the loan program on Tuesday, assessing Egypt’s progress on these financial reforms.

- Previous Article Italian-Palestinian Duo No Input Debuts Eponymous Electro EP

- Next Article Convenience vs Exploitation: Egypt’s Informal Labour Market

Trending This Week

-

Feb 23, 2026