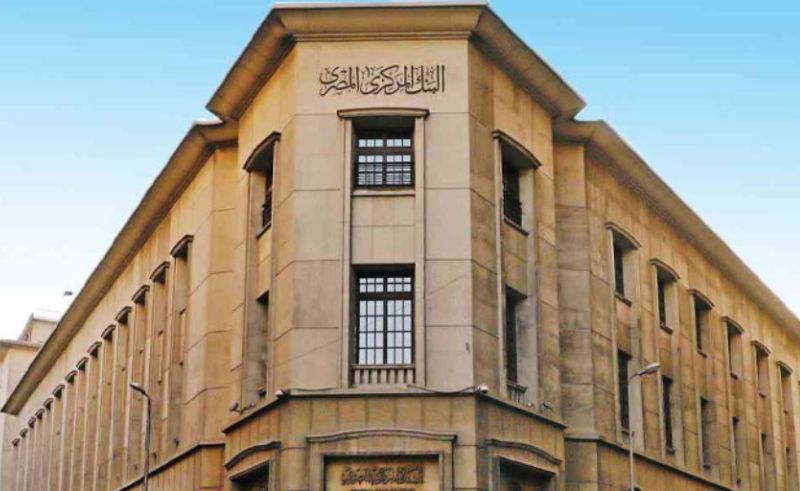

CBE Reports 181% Rise of Financial Inclusion Across Egypt

The number of Egyptians holding transactional accounts rose from 17.1 million in 2016 to 48.1 million by June 2024.

The Central Bank of Egypt (CBE) has announced an 181% increase in financial inclusion. Egyptians holding transactional accounts rose from 17.1 million in 2016 to 48.1 million by June 2024, bringing the financial inclusion rate up to 71.5% among citizens aged 16 and above.

New financial products, regulatory reforms and literacy initiatives are constantly being introduced to the Egyptian finance scene. Since 2017, CBE has opened millions of bank accounts, introduced mobile wallets and distributed prepaid cards to improve financial services nationwide.

Among the initiatives that led to this change was the Hayah Karima initiative, which helped improve banking services in rural areas by creating new accounts, installing ATMs, and directing EGP 43.5 billion toward small and micro projects. Financing for medium-sized enterprises has also surged by 388% since 2015; microfinance portfolios have reached EGP 93.2 billion and benefited over 4.6 million people.

Women’s financial inclusion has increased 252% since 2016, with 20.8 million women holding transactional accounts as of June 2024.

- Previous Article Palestinian Documentary ‘From Ground Zero’ Shortlisted for Oscars

- Next Article Brown Nose Drops New Banana Bread Matcha