Egypt’s Mobile Wallet Transactions Jump 80% in Q2 2025

Vodafone Cash led by wallets, volume and value; peer-to-peer transfers were the biggest use case. NTRA also cleared remittances into wallets in Egyptian pounds.

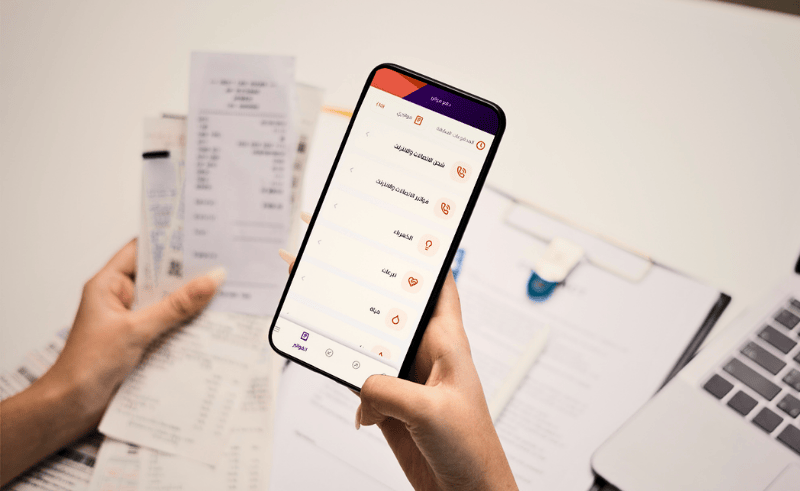

Egypt’s mobile wallet sector expanded in the second quarter of 2025, with the number of financial transactions rising 80% year-on-year to 718 million, according to data from the National Telecommunications Regulatory Authority (NTRA). The total value of transactions increased 72% to EGP 943 billion, compared with EGP 548.6 billion in the same quarter a year earlier. Active wallets also grew 29% to reach 46.3 million. By provider, Vodafone Cash maintained its dominance of the market, accounting for 55% of wallets, 78% of transactions, and 81% of transaction value. It was followed by e& Cash with 21%, Orange Cash with 19%, and WE Pay with 5%. Peer-to-peer transfers represented the largest share of activity, making up 54% of transactions by volume and 71% by value. Mobile and internet top-ups accounted for 20% by volume. Deposits represented 19% by volume and 15 percent by value, while withdrawals made up 5% by volume and 11% by value. Other payments, including bills, donations, and retail purchases, collectively accounted for 2%. Most deposits were made via bank-to-wallet transfers through InstaPay at 65%, followed by cash deposits at 22%, international remittances at 7%, card-to-wallet transfers at 3%, and ATM deposits at 3%. On the withdrawal side, 79% were direct cash withdrawals, 15% were other payments, and 6% were mobile or internet top-ups. To encourage wider adoption and enhance security, the NTRA introduced new regulations aimed at reducing fraud and protecting users. The authority also approved a service allowing Egyptians abroad to send remittances directly into local mobile wallets in Egyptian pounds.

- Previous Article SceneNoise x Power Horse: ‘Rap Ala El Tare2’ with Mosalem

- Next Article Six Unexpected Natural Wonders to Explore in Egypt