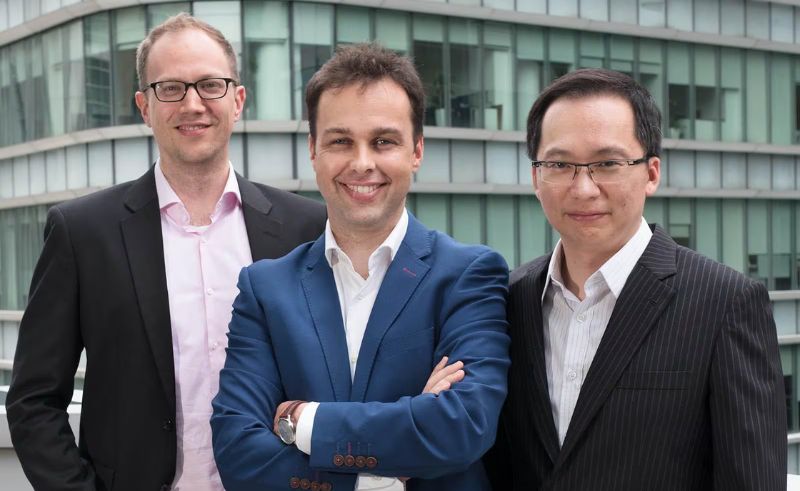

Digital Platform StashAway Launches Shariah portfolio in UAE

StashAway, a digital wealth platform, introduced Shariah Global Portfolios in the UAE with diversified holdings, low fees, and up to 13.7% historical annual returns.

StashAway, a key provider in the region’s technology and data services sector, has launched its Shariah Global Portfolio in the UAE, introducing a values-based digital investment option tailored to a growing demand for Shariah-compliant wealth management. The portfolios are globally diversified, structured across four risk levels, and designed for both new and experienced investors. Historical performance over the past five years has shown annual returns of up to 13.7 percent depending on the chosen risk profile. The portfolios consist of low-cost, Shariah-compliant exchange-traded funds, with holdings that span global equities, sukuk, gold, and sectors such as technology and emerging markets. All underlying assets are certified Shariah-compliant by issuers or fund managers. Shariah-compliant investing in the digital space is still relatively new, with the launch aiming to expand access in a market where over 75 percent of the population is Muslim. This reflects broader growth trends, as global Islamic finance assets are projected to reach $7.5 trillion by 2028. Long-term performance of Shariah indices has also been competitive, with the S&P 500 Shariah Index growing around four times in the past decade compared with 3.6 times for the conventional S&P 500 Index. The portfolios are professionally managed and dynamically re-optimised to maintain investor risk levels. Fees range from 0.2 to 0.8 percent annually, with no lock-ins or minimum investment requirements. Integration with Lean allows investors to set up recurring contributions quickly.

- Previous Article Ministry of Culture Opens Music Museums Free on September 15th

- Next Article Inside Egypt’s Seven UNESCO World Heritage Sites